The agricultural equipment manufacturer Indo Farm Equipment’s Initial Public Offering (IPO) enters its decisive final day, presenting investors with a last opportunity to participate in what has emerged as one of 2025’s early noteworthy public listings.

IPO Overview: Key Details at a Glance

The Rs 260.15 crore IPO combines a fresh issue worth Rs 184.90 crore (86 lakh shares) and an offer for sale (OFS) of Rs 75.25 crore (35 lakh shares). The company has strategically set its price band at Rs 204-215 per share, making it accessible to diverse investor categories.

Subscription Insights: Remarkable Day 2 Performance

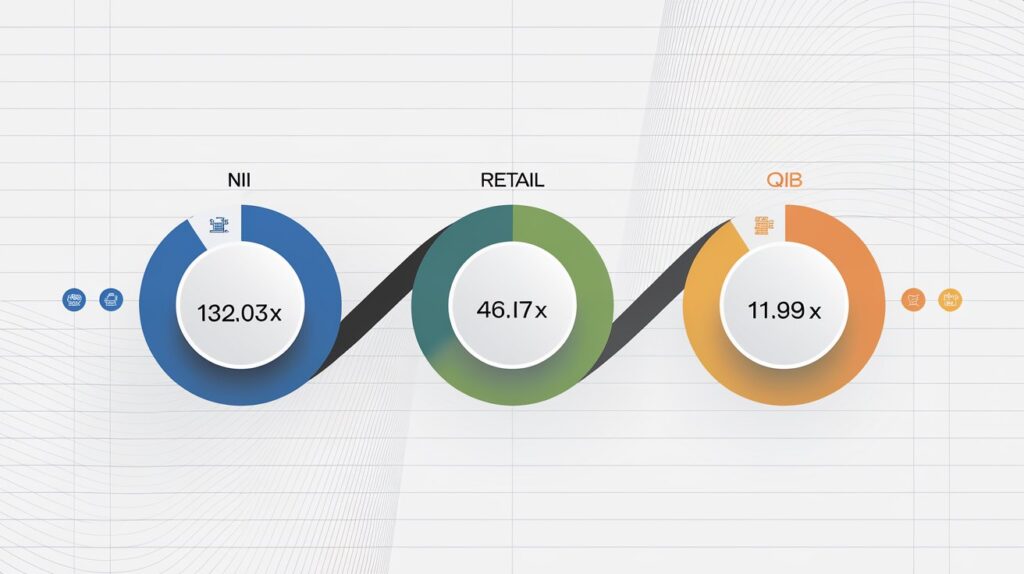

The offering has demonstrated exceptional market interest, achieving an overall subscription rate of 54.74 times by Day 2 (January 1, 2025). Here’s a detailed breakdown of category-wise subscription rates:

- Non-Institutional Investors (NII): Leading the charge with 132.03x subscription

- Retail Investors: Strong participation at 46.07x

- Qualified Institutional Buyers (QIB): Solid showing with 11.96x

Investment Parameters for Different Categories

Retail Investors

- Minimum lot size: 69 shares

- Required investment: Rs 14,835

- Price per share: Rs 215 (upper band)

Small Non-Institutional Investors (sNII)

- Minimum requirement: 14 lots (966 shares)

- Investment needed: Rs 2,07,690

Large Non-Institutional Investors (bNII)

- Minimum requirement: 68 lots (4,692 shares)

- Investment needed: Rs 10,08,780

Grey Market Premium (GMP) Analysis

Latest GMP Status (as of January 2, 2025, 7:02 AM):

- Current GMP: Rs 90

- Previous GMP: Rs 95

- Expected listing price: Rs 305

- Potential listing gain: 41.86%

Company Background & Business Model

Indo Farm Equipment, established in 1994, has built a robust portfolio including:

- Tractors

- Pick-and-carry cranes

- Specialized harvesting equipment

The company operates under two distinct brands:

- Indo Farm

- Indo Power

Their international presence spans multiple countries:

- Nepal

- Syria

- Sudan

- Bangladesh

- Myanmar

Important Dates for Investors

- Subscription Closing: January 2, 2025

- Share Allotment Date: January 3, 2025

- Expected Listing Date: January 7, 2025

- Listing Venues: BSE and NSE

IPO Management Team

- Lead Manager: Aryaman Financial Services Limited

- Registrar: Mas Services Limited

Investment Perspective

The strong subscription numbers and consistent GMP indicate robust market confidence in Indo Farm Equipment’s business model and growth prospects. The company’s established presence in both domestic and international markets, coupled with its diverse product portfolio, positions it well in the agricultural equipment sector.

Looking Ahead

With the listing scheduled for January 7, 2025, investors should monitor:

- Final subscription numbers

- GMP movements until listing

- Overall market conditions

- Agricultural sector trends

Note: GMP is an unofficial indicator and shouldn’t be the sole basis for investment decisions. Investors should consider company fundamentals, financials, and risk factors before investing.

#IndoFarmIPO #StockMarket #IPOAlert #InvestmentOpportunity #AgriTech